Medical network - February 7 clinical inspection, generic consistency evaluation, drug priority review, health care, medical insurance directory to adjust... In 2016, the pharmaceutical industry reforms, the industry in a frenzy. Media reports said, according to statistics, 2016 medical health industry mergers and acquisitions, more than 400 amount more than $180 billion. In response to the new change and drug companies to work hard, through a variety of strategies seek new development.

Spring 2017, frontier biological first announced a completed 300 million yuan C round of financing, then TianGuang solid, state health have more than 200 million yuan of investment, investment pharmaceutical mergers and acquisitions still charm. In 2016, which is carried out for drug firms local strategy? Which will continue into 2017 become popular again?

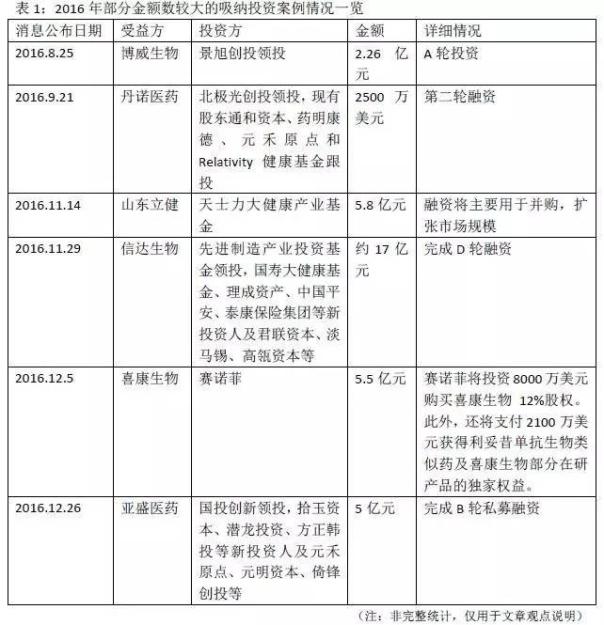

First, large amount of capital inflow, upgraded to a strategic investment

Cinda creature was founded in 2011, has long been outside labeled as the "not bad money". Since 2011, and round amount accumulated cinda creatures were done as much as $410 million (total RMB 2.81 billion). The D round in addition to the amount is huge, the biggest difference between cinda biological risk introduced.

To introduce risk investment, cinda biological YuDeChao chairman said that insurance money is gradually in the country's social security, medicare, and even some local governments will also be entrusted to the company's management of medical treatment insurance, risk information to enter for future products of insurance intervention also play an important role. In his view, "this is a strategic investment, not just financial investment."

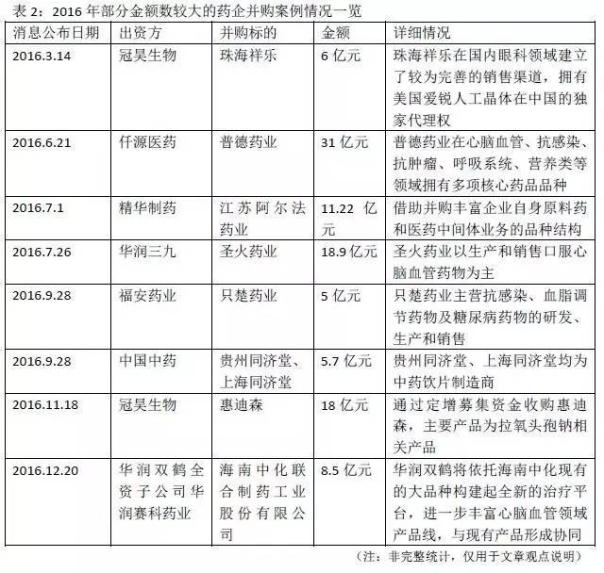

Second, improve the product line, and improve the competitiveness

With the split between "medicine" and the implementation of the "grading diagnosis", the integration of chain pharmacies. The future like a heart hall the pharmacy of the listed company will with the help of a capital market continues to expand, become the main industry consolidation.

And a series of reform policies, also makes the public hospitals become hot mark, attract social capital for active layout. The stable growth of public hospital mergers and acquisitions in the past two years, the acquired hospital mainly for dimethyl hospital comprehensive and specialized subject hospital. In 2016, people pharmaceutical, medicine, hainan sig pharmaceutical drug firms are piling with hospital, aims to further expand its medical services.

Four heat, cross-border mergers and acquisitions, medical and health industry is still a sunrise industry

On January 15, 2016, the Yangtze river rt by issuing shares and pay cash for 3.5 billion yuan, the acquisition of the Yangtze river pharmaceutical investment 100% stake. Then, the Yangtze river pharmaceutical investment completed on ocean chemistry, a new spirit, best three high quality pharmaceutical enterprise acquisition. Yangtze river embellish the deal to seize the favorable opportunity of pharmaceutical industry development, help to improve company resist risk and sustainable profitability.

On October 12, 2016, stone and its wholly owned subsidiary of chengdu east stone with 2.1 billion yuan to buy the Asian pharmaceutical 100% stake. Asia pharmaceutical r &d, production, sales, over-the-counter medicines and health food, which is mainly involves areas of prescription drugs at the same time, star product for the crack series cold medicine. Stone Oriental expectations through the acquisition to the medical health field transformation.

On November 29, 2016, guangdong GanHua by issuing shares and pay cash acquisition of wisdom with biological 51% stake, trading price for 673 million yuan. Guangdong GanHua mark is facing in urgent need of transformation, the company's main LED industry, biochemical industry and paper trade both in the industry downturn, the company has to specifically as a strategic transformation direction in the field of health care, the pharmaceutical industry as the main direction of future business diversification, seek new business growth point.

A brokerage, analysts said, each capital rush health industry, a national policy planning background basis, especially at the national level in 2015, have made it clear that the 'much starker choices-and graver consequences-in medical health industry development blueprint, listed companies expected to layout has a certain development. According to the documentation requirements of the state council, in 2020, total health services to achieve 8 trillion yuan of above, an important force to promote economic and social sustainable development.

Five, the big drug firms internal resources integration, dissolve the internal competition

Replacement of internal resources, integration has become an important part of the 2016 merger cases, typical representative is the modern pharmaceutical.

Modern pharmaceutical release in May 2016, "and pay cash purchase of assets through issuing shares and raising matching funds and related party transactions report (draft), plans to buy 12 assets, worth a total of about 7.7 billion yuan (1.8 billion yuan fundraising plan after shrink), the deal projected out of the characters of the group's overall strategic roadmap.

Plate operation strategy, which means its group's assets will be in accordance with the similar "merge like terms" train of thought. In resolving related listed companies and group competition problems at the same time, also makes the group capital operation channel smooth, integrated space already open. The industry analysis, the equity structure change after its group in the development of the overall situation will be more strong.

National medicine group, a new round of asset integration path followed by the rapid start, also share non-public stock way, complete the state-controlled Kang Chen 100% stake, Beijing, Beijing Beijing tot (shenzhen holds a 60% stake, etc, the price is about 6.145 billion yuan.

Six, the securities regulatory actions, tighten backdoor listings

In 2015 completed a backdoor listing five drug firms, breath in medicine, the health, longevity, nine zhi hall, and qinghai spring current performance situation is different, but still could not prevent drug firms "listed" determination. In the middle of 2016, the securities and futures commission issued a "notice", and ordered local securities regulatory bureau to strengthen restructuring public supervision of the project, realizing a complete coverage of the restructuring listed project site inspection, the backdoor listing in the most strict supervision, last year, can become a topic of case is tianshan textile merger jia Lin pharmaceutical industry events.

Since the end of 2015, tianshan textile plans through the assets to asset restructuring, and in August 2016. Tianshan textile assets into jia Lin pharmaceutical 100% stake valued 8.369 billion yuan. In assets of more than buy investment during the replacement value of the difference between the parts of about 7.57 billion yuan, from the tianshan textile to jia Lin pharmaceutical all shareholders to buy 8.65 yuan/shares of 875 million strands of DNA.

After the completion of the deal, tianshan textile will transition into the pharmaceutical industry, while jia Lin pharmaceutical shell landed a-share, with the help of the capital market, boost the rapid development of medicine industry.

conclusion

Influenced by various policies, medicine and local investment in mergers and acquisitions in 2016 the wind with new characteristics, simple external investment upgraded to a strategic investment, mergers and acquisitions between drug firms improve more diversified product line, other companies in the field of cross-border mergers and acquisitions into medical health field constant pace, hospital pharmaceutical enterprise m&a, large pharmacy chain, m&a and other types of terminal layout strategy started to present... In addition, large pharmaceutical group internal resources integration through capital operation channel is medicine of mergers and acquisitions in 2016 a new bright spot. With the securities and futures commission to strengthen restructuring listed project supervision, backdoor listings will be more rigorous.

Investment experts predict, 2017 pharmaceutical industry mergers and acquisitions trend, the niche of mergers and acquisitions is still very active, such as miniaturization of medicine enterprises will gradually specialization or takeover, drugstore chain integration will also be further intensified. |