Medical network, June 27 with tenofovir generics market to speed up the process, chengdu bate fumaric acid tenofovir two pyrazole cefuroxime ester (2016.11.23), fujian wide pharmaceutical raw hall of fumaric acid tenofovir two pyrazole cefuroxime ester capsules (2017.05.18), qilu pharmaceutical fumaric acid tenofovir two pyrazole cefuroxime ester tablet (2017.05.18) have been approved, tenofovir blockbuster products market has attracted much attention.

According to the data, the market size of hepatitis b drugs in China has grown from 6.881 billion yuan in 2011 to 16.276 billion yuan in 2015, with compound annual growth rate of 22.4%. China's hepatitis b drug market is expected to reach 20 billion yuan by 2020.

According to statistics, at present there are about 100 million or so people to the person that second liver virus is carried, accounts for about 8% ~ 10% of the population in our country, including more than 2000, ten thousand patients with chronic hepatitis b (CHB), and have in patients receiving standard treatment needed treatment accounted for only less than 20% of patients.

The size of China's hepatitis b market and the demand for drug use are huge, and the future will continue to maintain high growth momentum. In this case, nucleoside drugs gradually become the mainstream medicine for the treatment of hepatitis b. The commonly used nucleoside drugs are entecavir, tibiff, adefovir, lamivudine, tenofovir.

Nucleoside analogues: entecavir and tenofovir growth

According to the domestic sample hospital data, in 2016, the total sales volume of the sample hospitals of entecavir, tibiff, adefovir, lamivudine and tenofovir were 2.53 billion yuan. Among them, ntikavir sales were 1.71 billion yuan, or 63.4 percent. The sales volume was 2.8 billion yuan, accounting for 11.1%. Adefovir sales volume of 250 million yuan, accounting for 9.7%; Lamivudine accounted for 7.2% of sales of 180 million yuan. Tenofovir sales were 1.1 billion yuan, or 1.5 percent.

From nuclear nucleoside antiviral sales data in recent years, in 2016, entecavir occupy more than sixty percent of the nucleoside antiviral drugs market, has become the domestic main products nucleoside antiviral drugs. Ntikavir has maintained a high growth rate since 2010. In addition to the rapid growth rate of the other products, the sales of ibivdine, lamivudine and adefovir have declined.

In 2016, there were nearly 40 sales enterprises in the market of the sample hospital, which involved nuclear glycoside antivirals. Among them, the total sales volume of the top five enterprises was 2.23 billion yuan, accounting for 88.0% of the overall market. The top five companies are: the sales volume of Shanghai shi guibao in China and the United States is 8.3 billion yuan, accounting for 32.9%. The sales volume of zhengda tianqing pharmaceutical co., is 710 million yuan, accounting for 28.0%. GSK's sales were 310 million yuan, or 12.5 percent. Beijing novartis has a sales volume of RMB 280 million, accounting for 11.1%. The products of guangsheng hall in fujian province were 3.763 million yuan, accounting for 3.5 percent.

Entecavir: six to many markets for nucleoside antivirals

The global market is $11.92 billion

Entecavir was developed by bristol-myers squibb and was approved by the us FDA in March 2005. The product is called "Baraclude". In November 2005, the company's entecavir won the production approval and the product was named "bo lu ding". At present, there are 10 enterprises participating in the competition, including tablets, capsules and dispersants. According to the world's best-selling drug data, in 2016, the global sales of ntikave topped $11.92 billion.

Annual compound growth rate 47%

In 2015, entecavir first entered the domestic sample hospital for the TOP 10, with sales of 1.47 billion yuan, ranking 7th. In 2016, its sales volume was 1.71 billion yuan, ranking the TOP 2 in the ranking, ranking 5th, becoming the fastest growing product among the TOP 10 products in the domestic sample hospital market, with a growth rate of 16.2%.

From 2006 to 2016, entecavir sample hospital sales trends, domestic sales of 36.15 million yuan in 2006, 2016 annual sales of 1.71 billion yuan, 2006-2016 annual compound growth rate of 47.0%, in the domestic nucleoside antiviral drug market. When the product entered the Chinese market, it quickly replaced the position of early nucleoside drug adefovir. In 2009, the product entered the national health care directory, becoming the first choice for hepatitis b, and has been the top of the antiviral drugs for years. With its good curative effect and authoritative clinical guidelines and the academic promotion of various enterprises, the rapid growth of market sales has been a leading product of anti-hepatitis b virus drug market.

Domestic companies accelerated

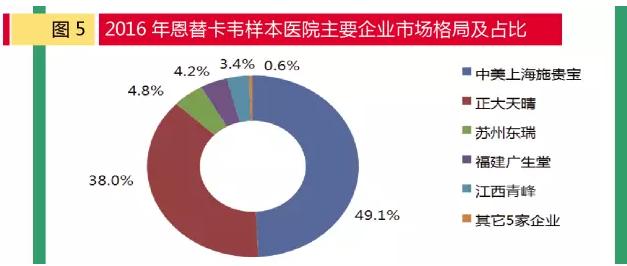

In 2016, entecavir market sales of the top five companies are: sino-us Shanghai bristol-myers, zhengda sunny pharmaceutical, suzhou rui pharmaceutical, east fujian wide raw pharmaceuticals, jiangxi qingfeng-xiangguang fracture pharmaceuticals, sales of 830 million yuan, 640 million yuan respectively, 50.86 million yuan, 70.28 million yuan and 57.27 million yuan. Shanghai bristol-myers squibb China and the United States of "road" market 48.8%, zhengda sunny pharmaceutical "run all" of "day" (37.7%), suzhou pharmaceutical products accounted for 4.7%, east fujian hall of raw products accounted for 4.1%, jiangxi qingfeng-xiangguang fracture products accounted for 3.4%, other five companies accounted for 1.3%. In terms of sales volume in 2016, Shanghai shiguibao has the largest share, but it is down 1.2% from the same period. Cp group accounted for nearly 40% of the total, up 48.8% over the same period. It can be seen that cp is speeding up the market in entecavir.

Since 2010, domestic entecavir manufacturers have broken the monopoly market of bristol-myers squibb, and since then several generic versions of domestic companies have been approved. With more and more factories, especially in recent years, the domestic market has been growing rapidly and the competition is fierce. At present, there are more than 80 enterprises that declare the preparation of entecavir.

Tenofovir: multiple positive growth rates

Global sales of $1.86 billion

Tenofovir gilead, developed by the United States, is a new type of nucleotide reverse transcriptase inhibitors, 2001 approved by the FDA as a treatment for HIV/AIDS, 2008 has been the European Union and the FDA approved for the treatment of hepatitis b, commodity called "Viread. Tenofovir is the star variety of gilead, which is an effective drug for AIDS and hepatitis b. In terms of the perineal rate and drug resistance of hepatitis b, it has some advantages compared with the main competing products, adefovir, tibiff and entecavir. According to the world's best-selling drug data, in 2016, the global sales of tenofovir were as high as $1.86 billion.

In 2016, it increased 354.1 percent

Tenofovir was approved by gilead to enter China in June 2008. The product name is "wei rui", the dosage form is the tablet, the specification is 300mg. In November 2009, gilead teamed up with glaxosmithkline to promote the company's antihepatitis b drug in the Chinese market. In April 2015, the CFDA authorized glaxo to list in China.

According to the domestic sample hospital statistics, tenofovir 2012 annual sales of 2.42 million yuan, 2015 annual sales of 25.09 million yuan, 2016 annual sales of 114 million yuan, a 354.1% increase from the same period, 2016 years is growing rapidly. Rapid growth of the product is mainly thanks to national drug price negotiations in May 2016 as a result, tenofovir monthly drug expenses from 1500 yuan to 490 yuan, a 67% decline, become the world's your lowest price indications for the treatment of chronic hepatitis b, it objectively promoted the tenofovir volume on the market in 2016. In addition, tenofovir has entered the 2017 medicare catalog, plus domestic listed three generic drugs, tenofovir overall market will usher in explosive growth, will also result in drug resistance hepatitis b market change.

Generic drugs were approved in succession

Chengdu times pharmaceutical co., LTD., which received the approval for the production of tenofuwei raw materials and tablets on November 23, 2016, was the first to receive the approval of AIDS, and then added the application to increase the indications of hepatitis b. According to the statistics, in May 2017, two more companies were approved for the production of tenofovir, which is the fumaric acid tenofovir dipyride capsule, which is used for hepatitis b infection in fujian guangsheng hall. The drug and its tablets of the fumaric acid tenofovir dipyril fumarate of qilu pharmaceutical. Since the door has been opened for the generic drugs, the price has dropped sharply and the overall market will grow significantly in the future.

Tenofovir is the latest generation of HBV drug resistance, is the world of chronic hepatitis b prevention and treatment guidelines recommend a first-line drug for the treatment of chronic hepatitis b, no matter from the curative effect, the market performance is a big variety. The scarce at home against hepatitis b virus drug varieties, clinical experts on tenofovir in patients with hepatitis b application is approved, that is currently the only, it does not produce resistant hepatitis b drug resistance, so many domestic enterprises also aimed at the market. More than 40 companies are currently filing, and more generic drugs will be approved by the end of 2017, and the domestic company is still in a tough game.

Conclusion > > >

At present, tenofovir's largest competitor is entecavir, both of which have similar mechanism of action, which are recommended by the hepatitis b treatment guidelines for first-line antiviral drugs. Entecavir went public and quickly dominated the market with good results. However, in the domestic market of tenofovir, there is still a wide gap between the sales of entecavir.

In 2017, tenofovir was included in the national health insurance directory and price reduction, and the policy advantage was obvious. A number of generics companies will be able to carve up the market for entecavir, and it will be interesting to see if they will move to the top of entecavir. |