Medical network - December 29, the state council tariffs commission released the 2017 tariff adjustment plan, starting from January 1 next year, China will adjust the import and export of certain goods tariffs.

To see what is involved in medical apparatus and instruments?

More than 30 YiXie product tariff reduction again

On September 3, 2016, the standing committee of the National People's Congress approved the law of the People's Republic of China's accession to the world trade organization (wto) in the amendment tariff schedules, decision points to phase out 201 tariffs on information technology products, including more than 30 medical equipment products.

On September 15, 2016, the state council tariff commission for 201 item of the MFN rates implementation of tax reduction for the first time.

On the basis of the latest tariff adjustment plans in 2017, began in September 2016 the tax breaks, for the first time will be on January 1, 2017 to continue to implement during June 30, 2017. However, since July 1, 2017, the MFN rates of related products will start the second lower taxes.

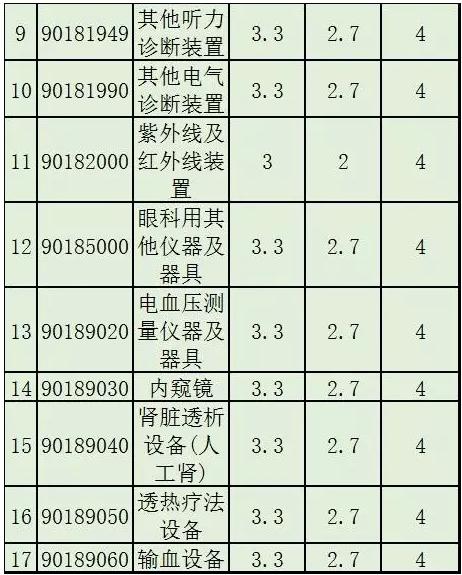

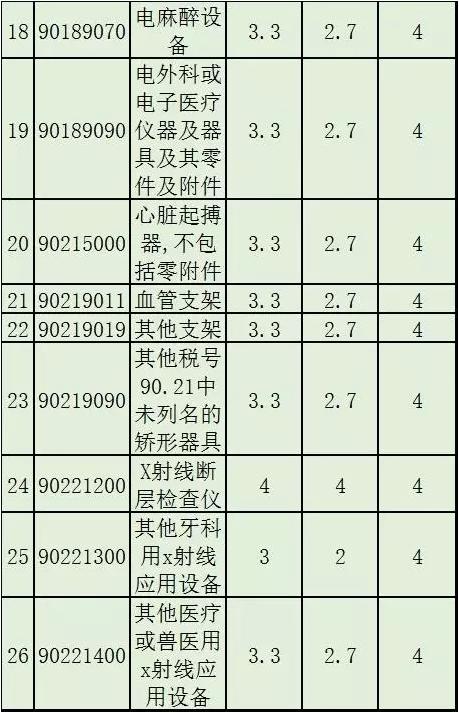

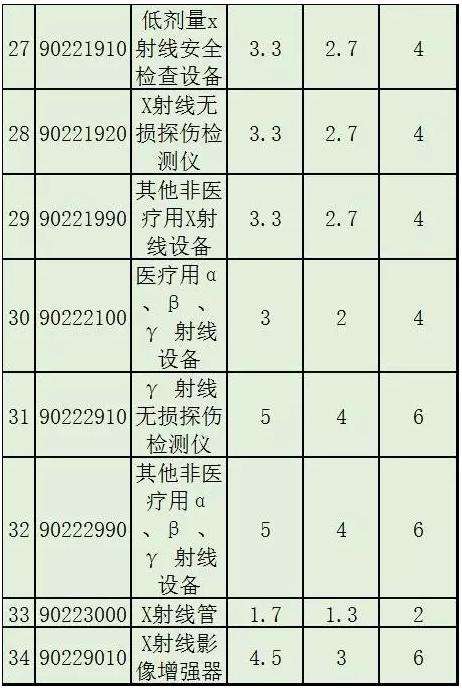

Second YiXie products lower taxes details are as follows:

Part of the import YiXie product implementation of the temporary tariff rate

Next year, according to the tariff adjustment scheme of 2017 "in China will also be part of imported goods in the form of temporary tariff rate cut tariffs.

Among them, since January 1, 2017, temporary tariff rate for 822 imported goods; Since July 1, 2017, will be the implementation of the provisional duty rates of import commodity goods range scale down to 805 items.

Temporary tariff rate to drop tariffs on goods list, medical apparatus and instruments product details are as follows:

The other major adjustments

Next year, according to the tariff adjustment scheme of 2017 "in China will speed up the implementation of free trade area strategy, continue to native to 25 part of the country or region imports the implementation of the agreement rate.

Among them, China and Australia, costa rica, Iceland, Pakistan, Switzerland, South Korea, New Zealand, Peru, the fta will further reduce the tax. The mainland and Hong Kong and Macao to implement zero tariff products range will also further expanded.

Our country the fta with asean, Chile, Singapore, the asia-pacific trade agreement and the cross-strait economic cooperation framework agreement (ECFA) under goods also to continue the implementation of the agreement rate, but the commodity scope remain unchanged and tax rate.

Also, 2017, our country about the least developed countries continue to implement preferential tax rate, commodity scope remain unchanged and tax rate. |