Since the September 7 news of the medical network, the pace of the listing of biosimilars in Europe and the United States has accelerated markedly (see table 1, table 2). By the end of August 2017, the EMA had approved the listing of 32 biosimilars, including 6 single anti-drug and 2 fusion protein similar drugs. The FDA has approved six new biosimilars, including four monoclonal drugs and one fusion protein.

In the future, as more and more biosimilars enter the U.S. and European markets, the market landscape of biologic drugs will undoubtedly change dramatically.

Eu PK us

The European Union is a pioneer in the regulation of biosimilars. In 2005, the European Union established a regulatory system for similar drug use, which clarified the way to declare the declaration, and the guiding principle was refined into the product category. In 2013, the European Union approved Remsima, an Anglo-American drug similar to the one developed by Celltrion, to become the first such drug to be approved by major regulators.

The United States started late, but quickly established a scientific review system. The U.S. didn't have a regulatory system for biological analogues until 2012. However, due to the great efforts of the United States in biometrics, the similarity of the Tier classification system was established, which laid a solid foundation for the scientific basis of similarity analysis. While still groping and practicing, the United States deserves other regulatory structures and similar drug development companies to learn from.

Who is the leader?

Celltrion, samsung Bioepis, anjin, novartis and BI are currently leading the development of similar pharmaceutical fields.

South Korean companies have taken the lead in competition for antibody-like drugs. Celltrion's listed companies include Remsima/Inflectra, rituximab, and the similar drug Truxima. Samsung Bioepis is listed in the company of Benepali, innasip, and Flixabi/Renflexis, adarwood, and Imraldi, a similar drug.

Japan made a series of achievements in the development of new drugs such as statin drugs in the 1970s, becoming a new drug research powerhouse, but has been left behind in the trend of biological drug development. South Korea drug firms have always been a lack of new drug research and development advantages, like Japan but development by high investment, high efficiency, high cost and high technology density of biological pharmaceutical industry, rapidly in the field of antibody like medicine.

In the us and European medicine companies, the traditional generic drugs giant sandoz has a similar drug Rixathon, and Erelzi, which is similar to the drug Rixathon. It is not uncommon for multinational drug companies to lay out similar drugs. Anjin and boehringer ingerheim are leading the way, and the two are listed in adarwood monoclonal antibodies Amjevita and Cyltezo.

The cut could be more than 15 per cent

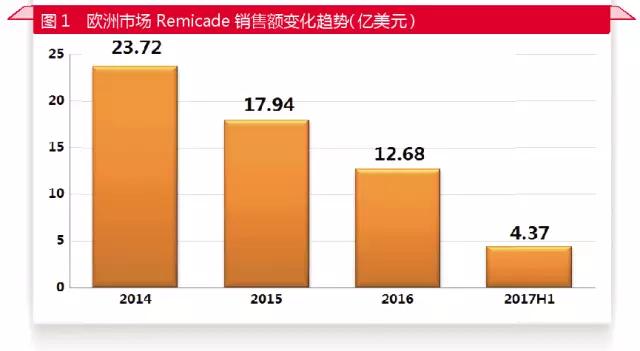

In the future, there will be more and more antibody similar drugs to the European and American markets, will greatly change the market pattern of the European and American antibody drugs. In the case of infuximab, which was hit by similar drugs in 2014, sales in Europe fell by less than half in three years.

The competition of antibody-like drugs has led to a significant decrease in the price of antibody drugs. The advisory body was expected to reduce the price of similar drugs by about 10 to 15 per cent, which is indeed close to the pricing strategy for the initial public offering of several antibody-similar drugs. But as competition intensifies, biosimilars tend to adopt a more aggressive pricing strategy, with a 20 per cent cut in the second year and a 30 per cent fall in the third year.

The author believes that antibody similar drugs may not cut down the cliff price like small molecule generics, but will still promote the price of related antibody drugs significantly lower. As a result, the patient can be significantly enhanced and the cost of drug expenditure is significantly reduced. Although anti-drug and car-t cell therapies are unlikely to be affordable drugs, it is still possible to become more affordable drugs through cost control and market competition.

|