| Micro-channel |

|

|

|

|

|

|

| |

| The winter has passed, five listed vaccine companies in the six months of the performance of the "big counter-attack"! |

| |

| Author:中國銘鉉 企劃部 Release Time:2017-9-20 10:33:55 Number Browse:1291 |

| |

In the first half of last year, the medical network was affected by the "vaccine incident", and the second type of vaccine manufacturers in China suffered a "Waterloo". At the time, the bioperformance of zhifei had fallen sharply, and Watson had lost 100 million yuan. This year, with the impact of the "vaccine incident", a number of vaccine companies, such as zhifei and Watson biology, have hit back. Among them, the operating income of zhifei biology, kangtai biology and long-life biology increased by more than 100 %.

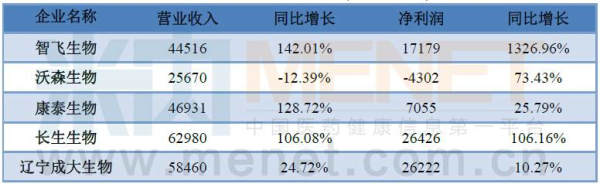

Table 1 report of 5 vaccine companies in the first half of 1717 (unit: 10,000 yuan)

Zhifei biology: net profit growth of 1326.96%

In the first half of 2017, zhifei bio-business revenue was 445.16 million yuan, up 142.01 percent year on year. Net profit attributable to shareholders of listed companies was 17.9 million yuan, up 1326.96 percent year on year. The company's main business revenue comes from second-class vaccine sales, said zhifei. Due to the uncertainty caused by last year's vaccine industry events, the new policy has gradually been implemented, and sales of the second type vaccine have been gradually restored.

Table 2: batch and issue of major products in the first half of zhifei biology (unit: 10,000 units)

Company a total of five kinds of independent products for sale, including AC - hib vaccine, polysaccharide ACYW135 epidemic encephalitis vaccine, hib vaccine, AC meningitis polysaccharide conjugate vaccine, micro card, three kinds of promotion or agent products for sale, respectively is zhejiang PuKang live attenuated hepatitis a vaccine and MSD 23 pneumonia and inactivated hepatitis a vaccine. Among them, the growth rate of the four independent products listed in table 2 in the first half of 2017 is astonishingly high.

In addition, Merck 4 price of flying creature sole agent HPV vaccine Gardasil in May also approved drug registration in the mainland area, is currently in yunnan province won the bid, the work of bidding in other provinces as well in order to promote, are expected to formally sales in 2018. According to the agreement between the company and Merck, the basic procurement plan for HPV vaccine is estimated to be about 1.14 billion yuan in the first year, about 14.83 billion yuan in the second year, and about 1.853 billion yuan in the third year. The sale of the product will bring a great profit to the company.

Watson biology: net profit fell by $118.88 million

In the first half of 2017, Watson's biological operating income was 256.7 million yuan, down 12.39 percent year on year. The net profit attributable to the shareholders of listed companies was RMB 4.301 million, compared with the same period last year, which was 11.88 million yuan, with a year-on-year increase of 73.43 percent, compared with a loss of 15.58 million yuan in the second quarter.

Watson biology said that the main line of the company's growth and loss was to actively expand its vaccine sales business, which enabled the simultaneous growth of the sales revenue and net income of the autonomous vaccine products. It is worth mentioning that Watson biological pneumococcal polysaccharide vaccine was 23 new products price in the end of July and formally therelease of on the market, is expected to form a company in the third quarter of this year new revenue and profit growth point.

Table 3: sales of independent vaccine for Watson in the first half of the year: (unit: 10,000 yuan)

At present, the company mainly produces and sales of independent vaccine products for: Hib vaccine (schering bottles and potting beforehand), freeze-dried meningococcal polysaccharide conjugate vaccine, AC group ACYW135 group of meningococcal polysaccharide vaccine and A group of group C meningococcal polysaccharide vaccine. In the first half of 2017, the company's own product business get better recovery, significantly enhance performance, including independent vaccine products sales rose 88.85% year-on-year in 2016, 2017 in the second quarter from the first quarter rose 194.65%.

Kangtai biology: revenue growth of 128.72% year on year

Table 4: product sales in the first half of kangtai biological products (unit: 10,000 yuan)

In the first half of 2017, the revenue of kangtai biological operations was 469.31 million yuan, an increase of 128.72% year on year. The net profit attributable to shareholders of listed companies was 70,550,000 yuan, up 25.79% from the same period last year. Among them, sales of a category of vaccines were 38.9 million yuan, accounting for 8.29% of the total revenue. The second-class vaccine sales were 429.25 million yuan, up 191.99 percent year on year, accounting for 91.46 percent of total revenue.

Conde biological said, revenue and profit growth trend of the main reasons are: 1) the vaccine flow into a vote after the reform, the vaccine factory high and generally increases, lead to income and corporate profitability improved; 2) the shandong vaccine incident led to a low base last year, with a significant increase in year-on-year growth.

Company is currently a total of 4 kinds of products for sale, including hepatitis b vaccine, Hib vaccine, leprosy duplex seedlings, quad, among them, especially in the genetic engineering vaccine (hepatitis b vaccine) and combined vaccine (quad miao) technology content is higher, the company's 60 mu g recombinant hepatitis b vaccine (saccharomyces cerevisiae), and quadruple seedlings at present belongs to the exclusive domestic product, the potential market.

Growth: revenue and net profit increased by 106% year on year

Table 5: product sales in the first half of the year: (unit: 10,000 yuan)

In the first half of 2017, the annual operating income of the long-lived creature was 629.8 million yuan, up 106.08% year on year. Net profit attributable to shareholders of listed companies was 264.26 million yuan, up 106.16 percent year on year. The sales of one type of vaccine were 62.46 million yuan, accounting for 9.92 percent of the total revenue. The second category of vaccine sales reached 561.8 million yuan, a year-on-year increase of 132.07 percent, accounting for 89.20 percent of the total revenue.

At present, immortality in selling products include freeze-dried live attenuated varicella vaccine, freeze-dried people use the rabies vaccine (Vero cell), freeze-dried live attenuated hepatitis a vaccine, influenza cracking, adsorption cell free the DPT vaccine combined vaccine and ACYW 135 group of meningococcal polysaccharide vaccine.

In the first half of 2017, immortality biological unit changchun longevity has carried out four influenza vaccine (adult) production, according to the work completed herpes zoster live attenuated phase I and II clinical research work, is currently in phase iii clinical work. In addition, changchun longevity and the Chinese academy of sciences institute of microbiology has officially signed in the first half of 2017 research and development of new village card vaccine technology transfer agreement, changchun longevity by 15 million yuan the transferee microorganisms inactivated vaccine preparation of proprietary technology, the new village card with microbial technology transfer agreement, will be conducive to accelerate the development of changchun longevity village card vaccine.

Big creatures: steady growth

In the first half of 2017, the company achieved a revenue of 584.6 million yuan, up 24.72 percent year on year. Net profit attributable to shareholders of listed companies was 262.22 million yuan, up 10.27 percent year on year. Into large biological said the company business performance has soared, major companies marketing pattern adjustment, vaccine products factory price for promotion, people use je vaccine market during recovery, sales year-on-year growth, foreign people with rabies vaccine sales year-on-year growth, product quantity price rising power of the company's operating income and net profit increased largely from the implementation.

Table 6: sales of major products in the first half of the year: (unit: ten thousand yuan)

The main business of liaoning is the research and development, production and sales of vaccines for people. At present, the company's main products include human rabies vaccine (Vero cells), and people with the brain inactivated vaccine (Vero cell). Among them, the rabies vaccine contains two kinds of the wild seedling squirt and the wild seedling, which together sales revenue reached 509.29 million yuan in the first half of the year. In addition, the company's diploid hepatitis a vaccine has been approved for clinical trials and other vaccine development is progressing smoothly.

It is worth mentioning that into big biological comply with new regulations require vaccine and vaccine circulation channels change, was the first to establish the main transportation, regional warehouse distribution of cold chain logistics system, government regulators and highly recognized in the industry of publicity and promotion.

conclusion

2017 is the year when the opportunity and challenge of vaccine enterprises coexist. The impact of the "vaccine event" is fading, and the growth potential of the vaccine industry is huge. The implementation of the new industry policy also put forward higher regulatory requirements for vaccine enterprises. Right now, and to enhance residents' disposable income and the prevention consciousness, two-child policy bring baby boomers, vaccine development and production input gradually increasing, product upgrading, indicates the domestic vaccine industry will get high growth.

Vaccines, therefore, enterprises should accurately grasp the direction of the market, with the change of industry policy and the national development planning in the field of medicine as the guidance, timely adjust strategy, pay attention to strategic orientation and market orientation, the combination of positive change sales model, increase the intensity of market development, expanding the brand influence, achieve business performance steady growth.

Source: listed company semi-annual report

Summer (shallow)

|

| |

Previous article:The 36 kinds of drug price negotiation varieties accelerate the landing expert: the price advantage of domestic drug is weakened

Next article:The inflection point has now come and the vaccine market is about to enter the fast lane

|

| |

|

|